“But nothing lasts forever: “Your time will pass,” Navalny told his jailers last week.

#Didi chinabased linkdoc ipotimes free

We and this is not just the West because it is not the West alone that believes in such ideas, the free people of the world who believe in peace, Justice and freedom, this order shall prevail and no dictatorship can overcome the highest order of freedom! We can and we must hold on to the highest ideas of humanity! They may look like a never ending nightmare but this too shall pass. #climateaction #plasticpollution #greenwash #keepcorporatesoutofCOP #CocaCola #COP27 #cop27egypt Sign and share widely to show Coca-Cola and the United Nations that they must prevent polluters from medling in urgent climate action and stop taking money to greenwash the image of major polluters. I was a delegate at COP26 and I was driven to tears by the brazen and overwhelming presence of corporate lobbyists and CEOs fighting to protect their interests at the expense of our environment and communities.

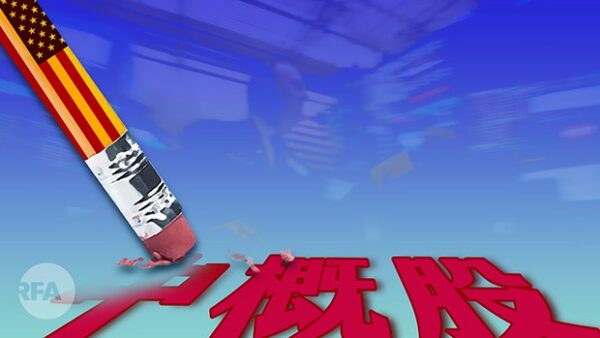

Plastic packaging, from extraction of crude oil to the shipping of plastic waste around the globe, is one of the world's largest contributers to climate change, as well as causing massive health problems and destroying vulnerable ecosystems.Ĭoca-Cola has a 30-yr long history of lobbying to derail and delay regulations and initiatives that would solve many of the problems of plastic, from efforts to weaken the EU Plastics Strategy to preventing desposit return schemes in developing nations. Much of this is generated in markets without effective waste management, meaning it ends up polluting the land, oceans and air. Today I have launched a petition to stop this madness.Ĭoca-Cola is the world's largest plastic polluter, responsible for 3 million tonnes of single-use plastic waste per year. A few months after bankers held a record for making Chinese companies public in New York and Hong Kong, they have had a rude awakening.Yesterday it was announced that The Coca-Cola Company will sponsor the UNFCCC UN COP27 Egypt climate conference in November. Bids are being filed and investors are suffering huge losses.Īfter a fortnight in which China repressed its Uber-like Didi Global Inc., just days after a commercial debut in the United States, a global chill was resolved, quickly followed by the State Council which announced a more detailed examination of all offshore quotes. A cybersecurity review for companies with data on more than a million users was proposed on Saturday before looking for listings in foreign countries. The warning signs had been blinking for some time. As insurers hit a record $ 1.5 billion in fees last year to help Chinese companies with initial overseas bidding, relations between China and the United States shrank. In December, Donald Trump signed a bill that could remove Chinese companies that do not comply with audit inspection rules.

Simultaneously, President Xi Jinping stepped up oversight of large technology companies, in part to secure the treasury of data they control. The moves jeopardize the frantic negotiation that took place during the pandemic and the lucrative offshore listing business that earned about $ 6.4 billion in commissions since 2014, when Alibaba Group Holding Ltd. they topped the league tables during that stretch, when nearly 40 percent of the commissions came from U.S. bids.īankers now say they expect most Chinese IPOs destined for U.S. stock exchanges to be suspended or diverted elsewhere, entering the projected revenue for the year given the significantly lower rates in Hong Kong. The quotation requirements in the financial center and in mainland China are also stricter, which means that there are no certain offers. “There are some uncertainties that can take a month or two to follow,” said David Chin, head of investment banking in Asia Pacific at UBS Group AG, about China’s changing rules in a briefing.

0 kommentar(er)

0 kommentar(er)